Years after the fact, the mainstream media is discovering that Gen Z is doomed. As CNN puts it, Gen Z is “earning less, has more debt, and higher delinquency rates than Millennials did at their age.”

In short, the pandemic did a number on Gen Z, followed by a wallop from Bidenflation, lagging wages, and now a looming recession.

How are they surviving? Debt.

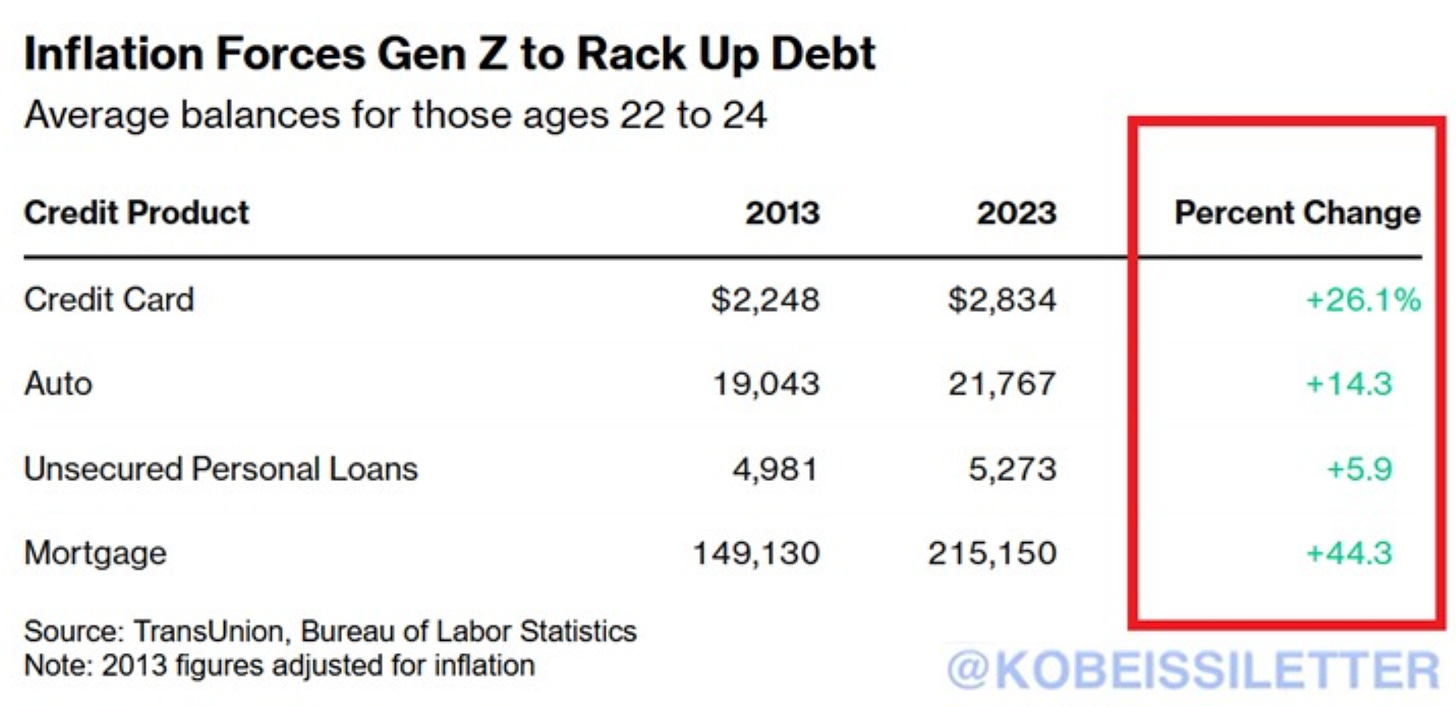

A new study from Transunion finds that, since 2013, average debt balances for those aged 22 to 24 has risen by 40%, including a 14% rise in auto loans and a 26% rise in credit card debt.

For those with a mortgage — which is a vanishingly low percent of Gen Z — the average mortgage debt is up by nearly half to $215,000 — quite a bit of debt at 24.

That, of course, is thanks to the Fed’s money printing that drives house prices to an arm plus a leg.

Gen Z Tapped Out

This debt has mirrored the savings rate, which plunged during Covid from an already abysmal 6% pre-pandemic to just 3.2%. So Americans are saving 3.2 cents on the dollar earned. For perspective, in the early 90’s it was three times that.

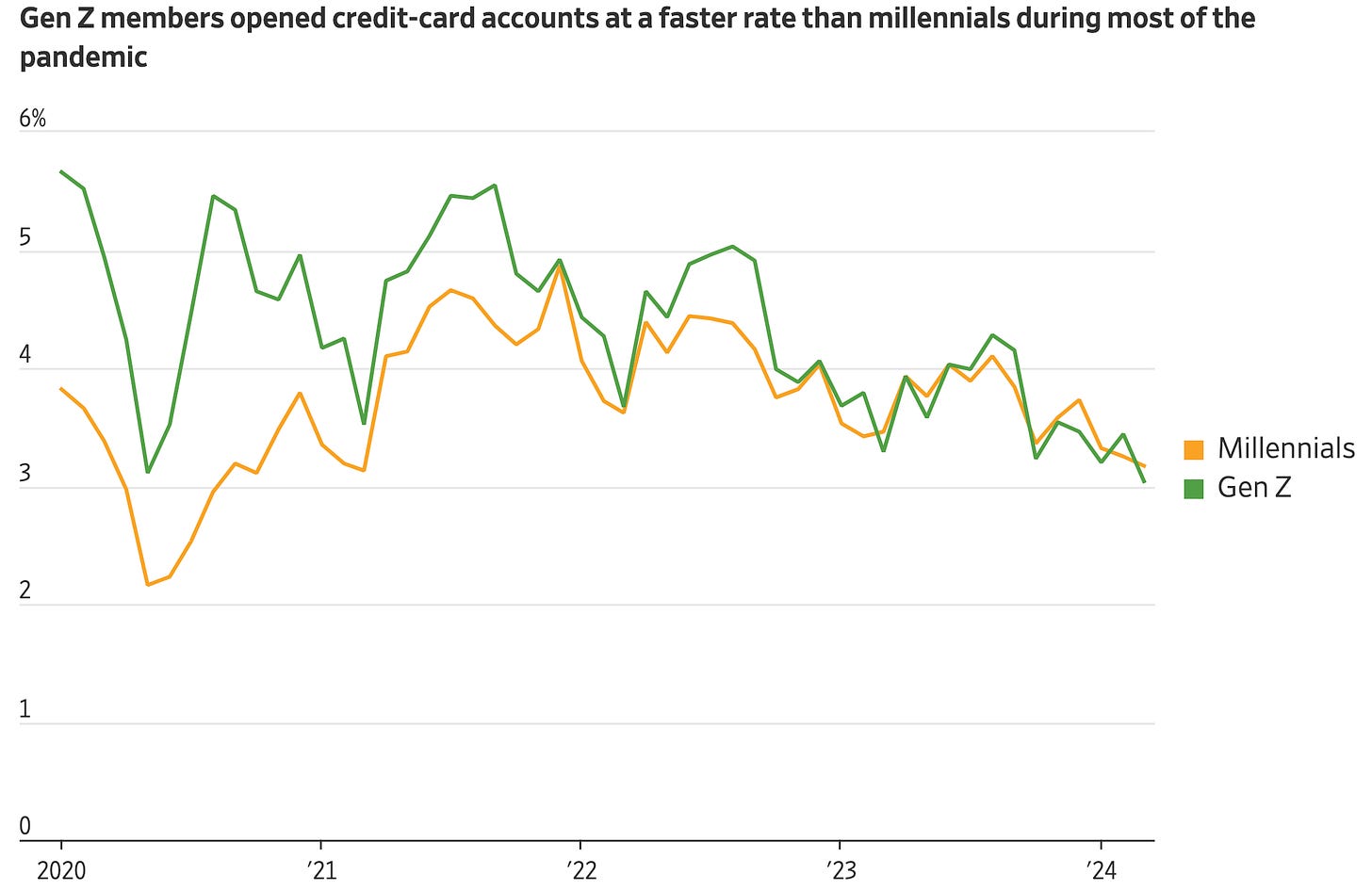

The pandemic apparently accelerated debt, and most dramatically among the young; Gen Z opened new credit cards at a faster rate than even Millennials during the pandemic — during 2020, there were multiple months when almost 6% of Gen Z’ers had opened at least one new credit card in the previous month.

Note Gen Z has the lowest income — therefore the lowest debt capacity — of any generation. Yet here they are sporting multiple cards and giving them a good workout.

All this debt, of course, is now driving delinquincy rates, with auto loan delinquencies rising by half, and credit card delinquencies doubling since 2022 to over 6% of credit cards in delinquency — not just carrying balances, but in actual delinquency.

“Shadow Debt”

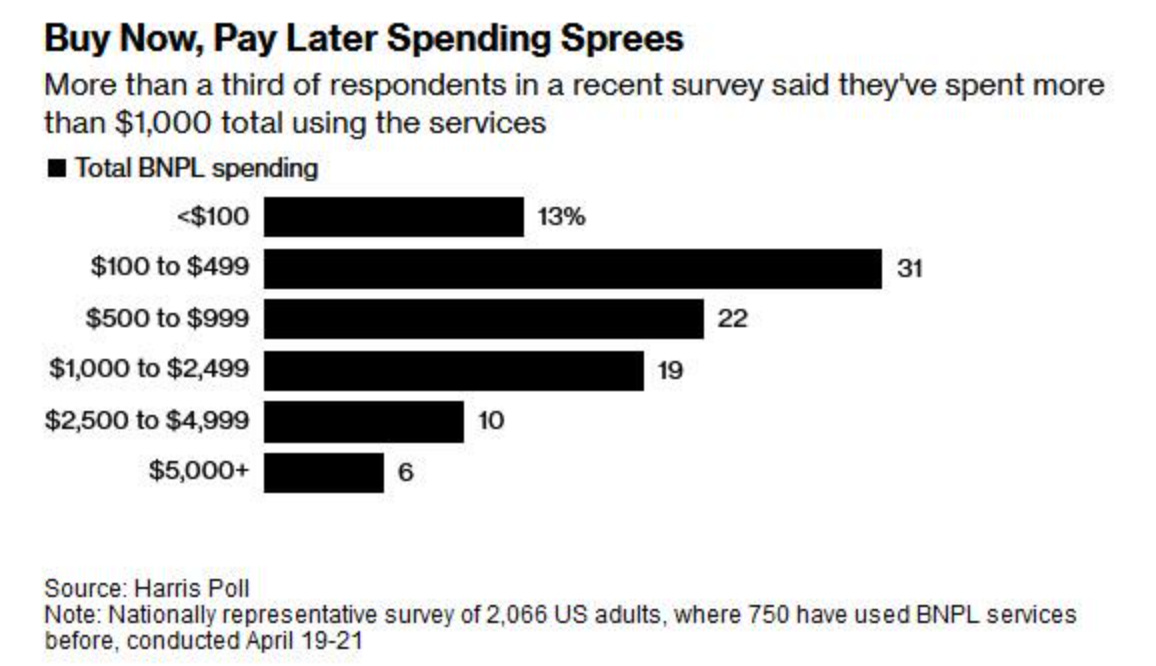

Keep in mind that this is all just the debt we can see — buy-now-pay-later has edged out avocado toast for Gen Z’s favorite daytime activity, totaling an estimated $700 billion in shadow debt.

In a recent Harris Poll, one out of three respondents said they’ve spent more than $1,000 on buy-now-pay-later, and 54% of users admitted spending more than they can afford.

One in four reported that buy-now-pay-later is making them fall behind on other lines of credit — note a credit card charges 24% interest per year, which is slightly lower than the mafia.

What’s Next

In a recent video, I mentioned the real-world fallout from all this debt, with declining sales for low-end staples from McDonald’s to Coke to Kraft Mac-n-Cheese — a Gen Z standby. Now Walmart is rolling out a private label brand of items under $5 to clothe our next generation in all the finery their debt will allow.

Gen Z is a financial train wreck — keep in mind this is the next generation of Americans.

They’re facing soaring prices and plunging wages, even as their formative experience of stimulus checks and student loan bailouts has taught them that maybe if they crash hard enough, Mom and Dad — er, the federal government — will bail them out.

We’re raising a generation of wards of the state, sustained not by productive work but by debt and handouts.

Given that government spending is unsustainable at 7% of GDP, they’ll eventually hit reality.

And they’ll be completely unprepared for it.

Republished from the author’s Substack

Disclaimer

Some of the posts we share are controversial and we do not necessarily agree with them in the whole extend. Sometimes we agree with the content or part of it but we do not agree with the narration or language. Nevertheless we find them somehow interesting, valuable and/or informative or we share them, because we strongly believe in freedom of speech, free press and journalism. We strongly encourage you to have a critical approach to all the content, do your own research and analysis to build your own opinion.

We would be glad to have your feedback.

Source: Brownstone Institute Read the original article here: https://brownstone.org/