Over recent months, the mainstream media has been overtaken by fears of a debt crisis in the developing world. The rapid interest-rate rises implemented by Western central banks have refreshed memories of the Eighties, when a similar tightening cycle precipitated a fiscal collapse and ushered in what came to be known as a “lost decade” for many countries. In that vein, a recent UNCTAD report noted the great increase in debt that occurred in emerging markets during the pandemic, and warned that a similar cycle could be brewing.

Perhaps. But too great a focus on the developing world is obscuring a very real and impending debt crisis elsewhere. Because even though the report noted that 30% of global debt is owed by emerging markets (and has risen sharply), that figure is misleading. Nearly half that debt it is owed by one country: China.

If you take the Middle Kingdom out of the mix, the developing world is actually in reasonably good shape. China, by contrast, has followed a trajectory more like that of a Western country. Its debt soared after the 2008 financial crisis, and then some more after the pandemic. Private debt, which is much less of a feature in developing countries, has similarly risen to record levels, bringing China’s total debt stock to nearly three times the size of the economy, in line with Western competitors. Well before reaching those levels, a typical emerging market would have run into a fiscal crisis. The classic example is Argentina, a country whose official debt burden may rival China’s but whose private debt is negligible. It is now mired in an intractable economic stagnation — one that Javier Milei’s wheeze of abolishing the country’s central bank will not ameliorate.

The fundamental difference, however, is that other emerging markets don’t have anything like the pools of capital available in China. Being the world’s second-biggest economy with an extraordinarily high savings rate of nearly 50%, there is an immense bedrock of loanable funds to play with. Even though China’s financial markets are gradually globalising, only around 3% of its government bonds are owned by foreigners, compared to about a quarter of the US Treasury market and nearly a third of UK gilts.

This gives the Chinese government considerable leeway to borrow since it is less exposed to the “kindness of strangers” that imposes such narrow guardrails on most countries — and not just in the developing world, as Liz Truss discovered to her grief last year. But on the other hand, such an abundance of loanable money has fostered a carefree spending pattern that would get punished by credit markets elsewhere. China has repeatedly pumped money into its economy to stimulate growth, mainly with infrastructure and property-building programmes, the scale of which has no precedent. In 2019 alone, for instance, China installed more high-speed rail capacity than Europe had in the previous decade.

Each of these stimulus packages produced the intended jolt to the economy. But every sugar rush eventually wears off, after which the economy is left saddled with excess capacity. Not all those train lines become profitable; not all those buildings get occupied; not all the steel produced by those expanded plants gets bought. As a result, after peaking just before the 2008 global financial crisis, the country’s growth rate has been trending downwards, much as has been the case in developed economies.

In this and in its seemingly endless ability to resort to debt-financed stimulus, China thus bears more resemblance to a developed economy than to an emerging one. And the structural problems it faces — an ageing population, slowing workforce growth, rising debt — mirror those of the West. Nevertheless, China’s GDP per capita still stands well shy of its Western rivals, at about a quarter of Britain’s and a sixth of America’s. Even though the country still has a long way to go before it can deliver rich-country standards of living to its people, it’s running into some of the same barriers to growth as Western countries.

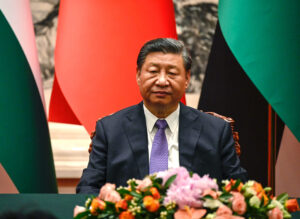

This hard reality is already a serious concern in Beijing. The legitimacy of the ruling Communist Party rests substantially on its ability to deliver better lives for its citizens. The historical memory of China’s “century of humiliation” — when the proud country became playground for Western empires from the mid-19th century to the end of the Second World War — hangs heavily over the country’s leaders. They know they have to keep pace with their major Western rivals, not least the United States. But the debt-fuelled economic model of the last 25 years is running out of road. News this week that Chinese borrowers are defaulting in record numbers on their debts, everything from mortgages to business loans, led the Moody’s credit agency to downgrade the country’s debt rating, highlighting the challenges the country faces trying to reinvigorate its economy.

After punishing lockdowns ground China to a standstill during the pandemic, it was expected that reopening alone would bring a sharp rebound. That strategy has demonstrably failed, and now the Chinese authorities are scratching around for a solution. But, in an inversion of a large business that is “too big to fail”, China’s issue is that it has become too big to succeed. The problem with the supply-sided stimulus programmes it has relied on is that the excess capacity must be offloaded. Someone has to buy all that new output, lest the country be saddled with debts but no revenues to pay for them.

For decades, the rest of the world was happy to be a sink for Chinese products. In fact, the outsourcing of production to China helped reinvigorate Western capitalism. And although this helped to accelerate the relative deindustrialisation of many Western countries, the losses were offset in the disinflation imported from China. Falling inflation, in turn, not only kept the cost of living down but allowed interest rates to fall, making credit cheap and fuelling property booms in the West.

After the party, though, the comedown. Today, China’s trading partners are pushing to reduce their exposure to its markets. Though “decoupling” is still something of a geostrategic fantasy (the West is still deeply embedded in Chinese supply chains), the long-term trend nevertheless appears not to favour China’s export-led strategy. The country is just too big now to get away with it. Michael Pettis recently calculated that for China to continue engineering an annual growth rate of 4-5% based on its export-oriented model, its share of global manufacturing output, already an astonishing 31%, would have to rise to 36%. The only way that could happen is if other countries were willing to allow theirs to decline, at a time when they are desperately trying to onshore key industries like semiconductor manufacturing.

Realistically, the only way out of this cul-de-sac is for China to boost consumption at home, buying more (a lot more) of its own goods. Economically, this is eminently feasible. Precisely because the country’s saving rate is so high, the authorities could engineer a reduction in savings so that citizens consumed more and saved less. That would create a more balanced economy which might then have a chance of attaining a stable growth pattern. The obvious means of engineering such a transition would be to raise wages and boost welfare spending, since a lot of household saving in China is motivated by the need to build rainy-day funds in the absence of a generous welfare state.

Politically, though, that’s easier said than done. First off, raising wages would also reduce the international competitiveness of Chinese firms. Given that there is now a powerful and well-connected constituency invested in the low-wage growth model, this would mean the government would have to get involved in the business of picking who the losers will be. Even for an autocratic regime that is no simple task, since the ultimate success of policy reforms depends on the willing acquiescence of firm managers, as Xi previously discovered when his “common prosperity” campaign hampered business confidence. As for boosting welfare spending, Xi Jinping is known to have an aversion to the Western-style welfare state, which he believes fosters a fecklessness that would sap China’s strength.

The exact way forward for China remains far from clear. What is apparent, though, is that while the model of authoritarian capitalism proved extremely effective at lining people up and getting them to make sacrifices for national development, it is less good at dispersing this newfound wealth across the population. China is coming to the end of an era, and faces an economic evolution as profound as the great opening-up presided over by Deng Xiaoping. Xi Jinping must prove himself capable of piloting his country through this transformation, or watch China’s hard-won prosperity wither away.

Disclaimer

Some of the posts we share are controversial and we do not necessarily agree with them in the whole extend. Sometimes we agree with the content or part of it but we do not agree with the narration or language. Nevertheless we find them somehow interesting, valuable and/or informative or we share them, because we strongly believe in freedom of speech, free press and journalism. We strongly encourage you to have a critical approach to all the content, do your own research and analysis to build your own opinion.

We would be glad to have your feedback.

Source: UnHerd Read the original article here: https://unherd.com/