There was an oblique message buried in a New York Times story on the growing crisis in commercial real estate in cities. Yes, this is exactly the kind of article that people pass over because it seems like it doesn’t have broad application. In fact, it does. It affects the core of issues like our city skylines, how we think about urbanism and progress, where we vacation and work, and whether the big cities are drivers or drains on national productivity.

The note mentions the “broader distress brewing in the commercial real estate market, which is hurting from the twin punches of high interest rates, which make it harder to refinance loans, and low occupancy rates for office buildings — an outcome of the pandemic.”

We are used to this kind of language blaming the pandemic for the results of lockdowns. Of course, it was a man-made decision to turn a respiratory virus into an excuse to shut down the world. The lockdowns blew up all economic data, generating seesawing graphs on every indicator never seen in industrial history. They also made before/after comparison extremely difficult.

The consequences will echo long into the future. The high interest rates are a result of trying to slow down the money spigot unleashed in March 2020, in which more than $6 trillion in new cash appeared out of nowhere and was distributed as if by helicopter.

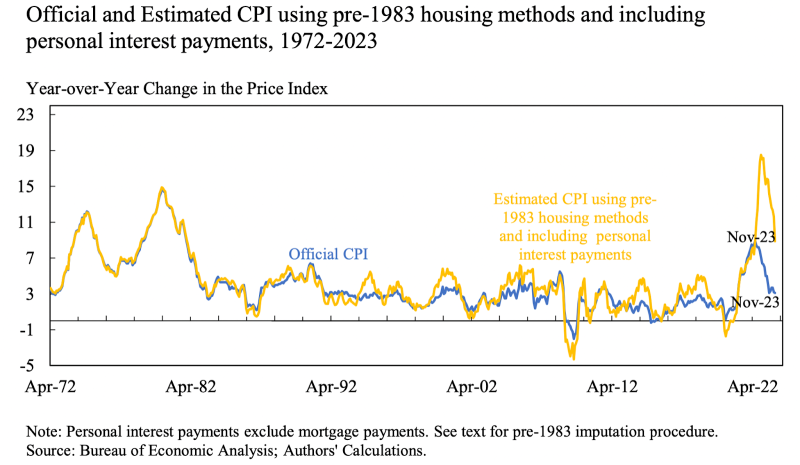

What did the money injection do? It generated inflation. How much? Sadly, we do not know. The Bureau of Labor Statistics simply cannot keep up, partially because the Consumer Price Index does not calculate the following: interest on anything, taxes, housing, health insurance (accurately), homeowners insurance, car insurance, government services like public schools, shrinkflation, quality declines, substitutions due to price, or additional service fees.

That’s a major part of what has gone up, which is why data on particular industries shows a huge gap (groceries up 35% over four years) and why ShadowStats estimates inflation in double digits two years running, having peaked at 17%. Just adding in interest, a paper from NBER estimates, takes 2023 inflation to 19%.

Various studies have shown that since 2019 fast food prices — a gold standard in financial markets for measuring true inflation — have outpaced official CPI by between 25% and 50%.

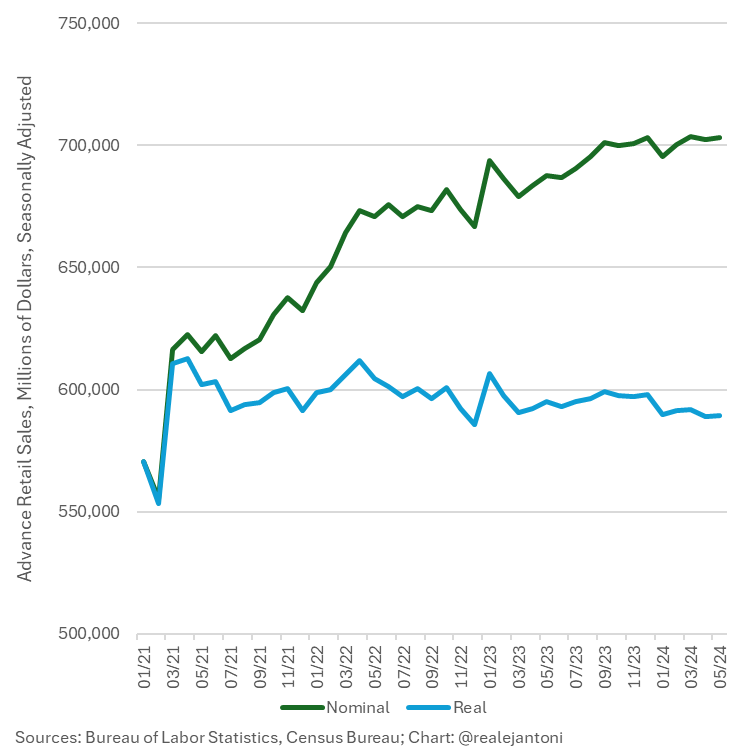

Getting the inflation data wrong is only the start of the problem. We are lucky if any government data even adjusts for the wrong numbers. Consider retail sales as just one example. Let’s say you bought a hamburger last year for $10 and you bought one this week for $15. Would you say that your retail spending is up 50%? No, you just spent more on the same thing. Well, guess what? All retail sales are calculated this way.

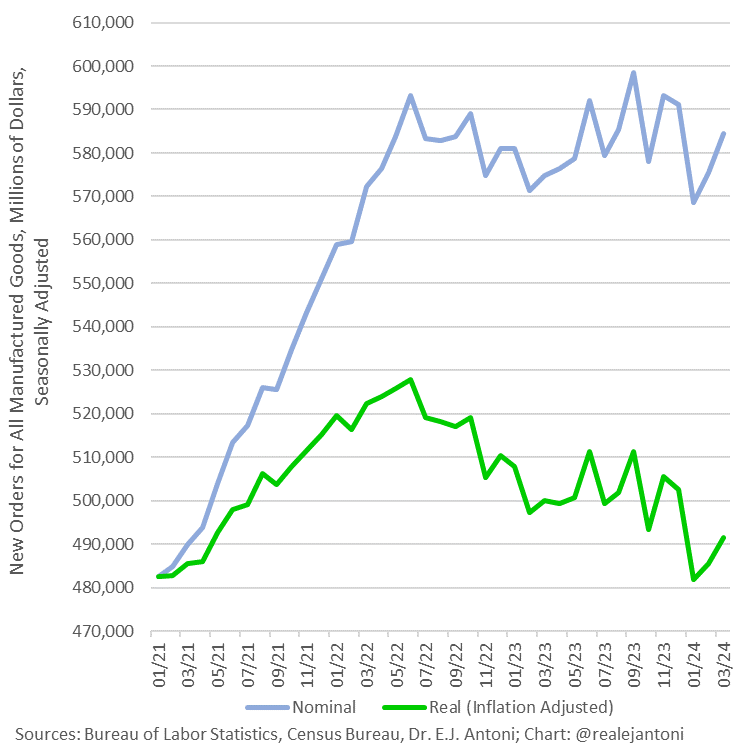

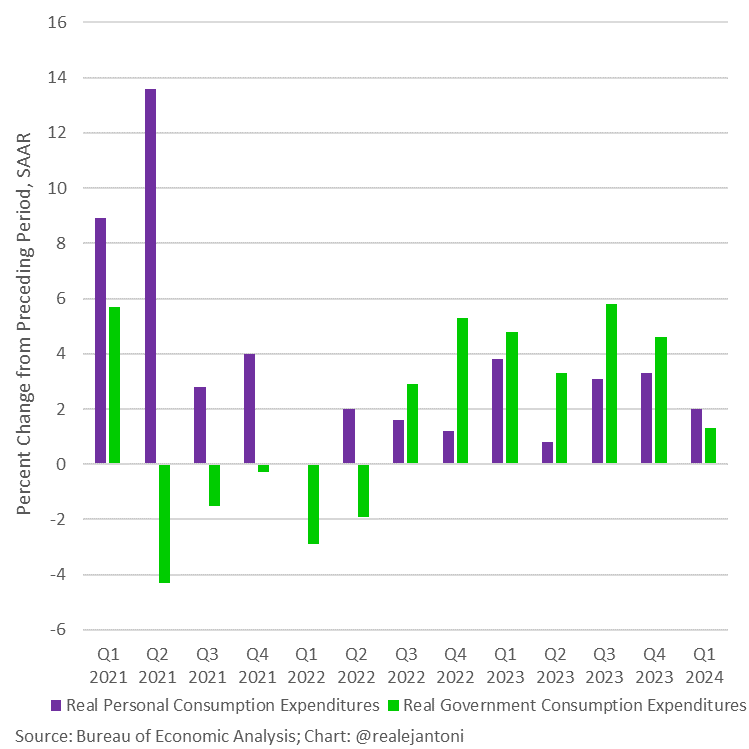

It’s the same with factory orders. You have to do the inflation adjustments yourself. Even using conventional data, which are wildly underestimated, wipes out all gains of the last several years. EJ Antoni is one of the few economists actually keeping up with this stuff, and he produces the following two charts.

As EJ writes: “This is factory orders before and after adjusting for inflation: what looks like a 21.1% increase from Jan ’21 to Mar ’24 is only a 1.8% increase – the rest is just higher prices, not more physical stuff; worse yet, real orders are down 6.9% since their highwater mark in June ’22.”

Imagine the same charts but with more realistic adjustments. Are you getting the picture? The mainstream data being dished out daily by the business press is fake. And imagine the same charts above redone with inflation in the double digits as it should be. We’ve got a serious problem.

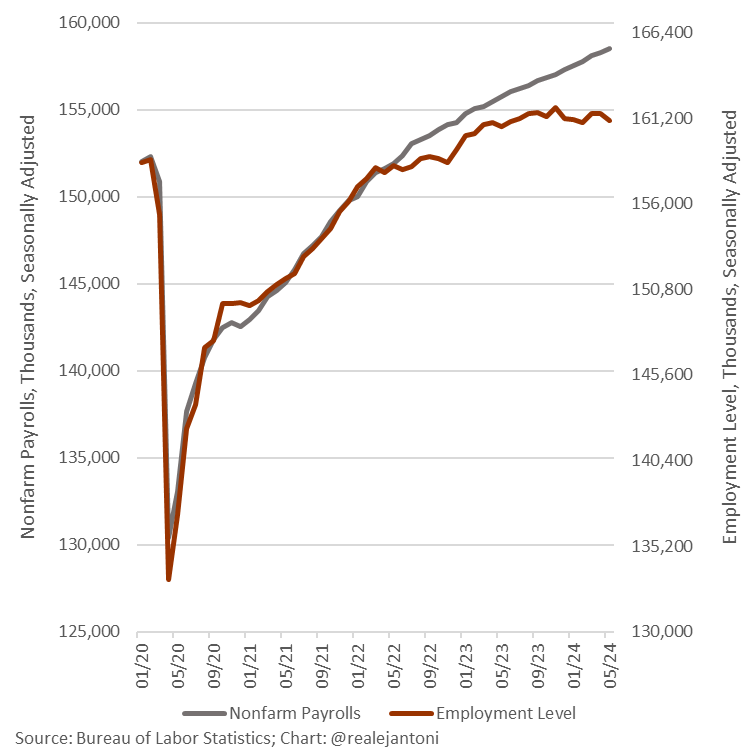

The problems with the employment data are getting to be more well-known. Essentially, the establishment data that is normally reported is double-counting or just plain inaccurate, and there is a huge divergence with the other method of counting jobs via household surveys. EJ again offers this look.

In addition, neither worker/population ratios nor the labor participation rate are back to pre-lockdown levels.

Now consider GDP. In the old formula hammered out in the 1930s, government spending adds to the GDP while cuts subtract from it, just as exports add and imports subtract. Why? It’s an old theory rooted in a kind of Keynesian/mercantilism that no one seems ever to change. But the bias is profound these days with explosive government spending.

To calculate whether and to what extent we are in recession, we look not at nominal GDP but real GDP; that is, adjusted for inflation. Two down quarters are considered recessionary. What if we adjust pathetic and seriously mis-estimated output numbers by a realistic understanding of inflation over the last few years?

We don’t have the numbers but a back-of-the-envelope suggests that we never left the recession of March 2020 and that everything has been getting gradually worse.

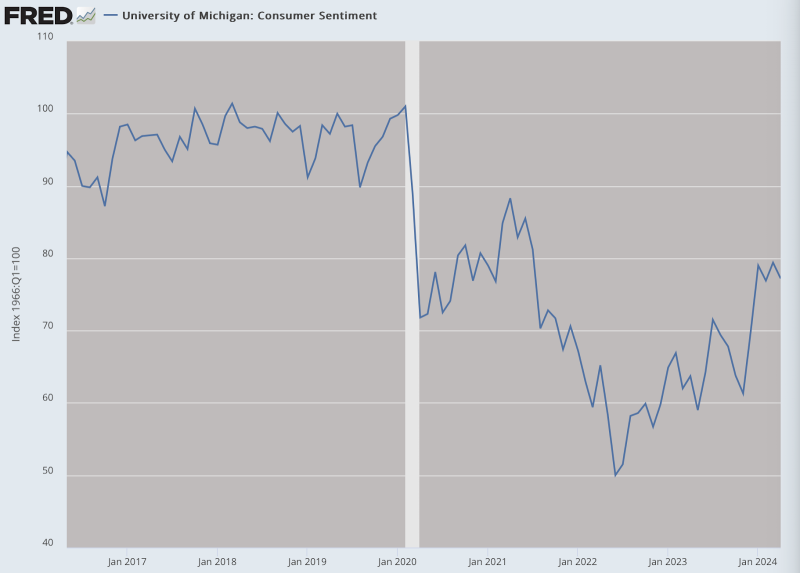

That appears to fit with every single consumer sentiment survey. It seems likely that people themselves are better observers of reality than government data collectors and statisticians.

So far, we’ve dealt briefly with inflation, output, sales, and output, and find that none of the official data is reliable. One mistake bleeds to others, such as adjusting output for inflation or adjusting sales for increased prices. The jobs data is particularly problematic because of the problem of double-counting.

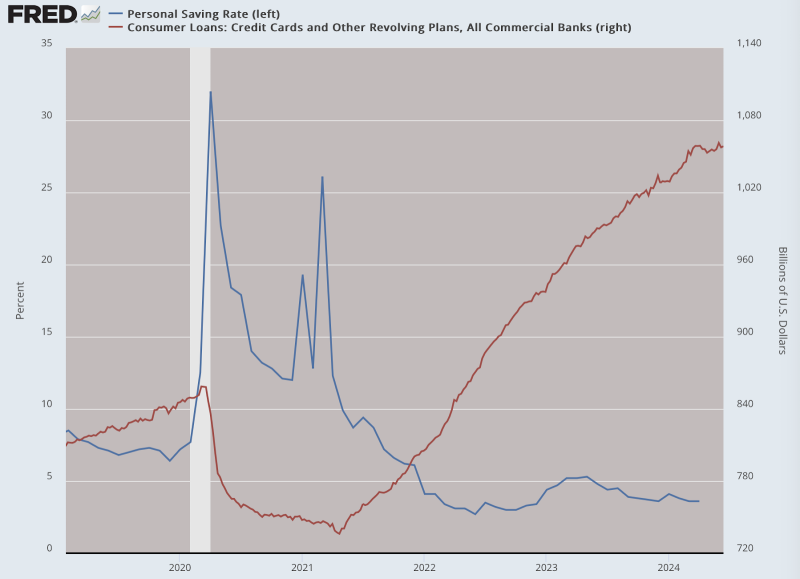

What to know about household finance? The flipping of savings rates and credit card debt tell the story.

When you add it all up, you get a strange sense that nothing we are being told is real. According to official data, the dollar has lost about 23 cents in purchasing power over the last four years. Absolutely no one believes this. Depending on what you actually spend money on, the real answer is closer to 35 cents or 50 cents or even 75 cents…or more. We do not know what we cannot know.

We are left to speculate. And this problem is combined with the reality that this is not just a US problem. The increase in inflation and the decline in output is truly global. We might call this an inflationary recession or high inflationary depression, all over the world.

Consider that most economic models used through the 1970s, and still today, postulate that there is a forever tradeoff between output (with employment as a proxy) and inflation, such that when one is up, the other is down (Phillips curve).

Now we face a situation where the jobs data are profoundly affected by bad surveys and labor dropouts, output data is distorted by history-making levels of government spending and debt, and no one is even trying anymore to provide a realistic accounting of inflation.

What the heck is really going on? We live in data-obsessed times with seemingly magical abilities to know and calculate everything. And yet even now, we seem to be more blind than ever before. The difference is that nowadays, we are supposed to trust and rely on data that no one even believes is real.

Going back to that commercial real estate crisis, for the New York Times story, the large banks would not even talk to the reporters doing the story. That should tell you something.

We live with a don’t-ask-don’t-tell economy. No one wants to say hyperinflation. No one wants to say economic depression. Above all else, never admit the truth: the turning point in our lives and the precipitating event to the whole calamity for the world were the lockdowns themselves. All else follows.

Disclaimer

Some of the posts we share are controversial and we do not necessarily agree with them in the whole extend. Sometimes we agree with the content or part of it but we do not agree with the narration or language. Nevertheless we find them somehow interesting, valuable and/or informative or we share them, because we strongly believe in freedom of speech, free press and journalism. We strongly encourage you to have a critical approach to all the content, do your own research and analysis to build your own opinion.

We would be glad to have your feedback.

Source: Brownstone Institute Read the original article here: https://brownstone.org/