The New York Times has published a strange article by Justin Wolfers, an economist at the University of Michigan. The headline is that his economist brain makes him say with regard to inflation: “Don’t worry, be happy.” The article gives the reader as much reason to trust economists as you do epidemiologists, which is to say not at all.

The idea is that if both prices and income go up together, it all pans out in the wash. Yes, the article goes on for 1,000 words to say that but that’s its essence. The thought is that the 25 percent inflation we’ve experienced over the last 4 years really hasn’t done any damage. Money is neutral to economic exchange and so is inflation.

So just chill!

Inflation is a lot scarier when you fear that today’s price rises will permanently undermine your ability to make ends meet. Perhaps this explains why the recent moderate burst of inflation has created seemingly more anxiety than previous inflationary episodes…we’re in the midst of a macroeconomic anxiety attack.

Now, on the face of it, this claim is notable because he nowhere claims that inflation does actual good, so perhaps that is a step in the right direction. If that’s true, what’s the point of printing up $5 trillion-plus in 2020 and following? No question that this is the direct cause of the loss in purchasing power of the dollar that we’ve experienced. If money is entirely neutral and inflation essentially irrelevant, the Fed should simply freeze the money stock if only to reduce anxiety.

Of course the professor doesn’t suggest that. This is for a reason. Inflation is a form of taxation and wealth redistribution from the poor and middle class to the rich and powerful. Without it, that pathway to wealth transfers would not happen.

Let’s see what the article overlooks about inflation in real life.

First, every inflation comes with injection effects. Not all new money enters the economy at the same time. Some people get it earlier and thereby can spend it before its value starts to fall and fall. They are the winners from inflation. It’s a giant subsidy to the ruling classes.

Think about 2020 and early 2021. Millions of banked businesses and consumers, plus governments most especially, found themselves flush with new cash. Savings soared but so did spending on high-tech goods and delivering services to make the work-at-home economy function.

Many institutions benefited: banks, governments, online learning platforms, online merchants like Amazon, streaming services, and so on. This was part of the Great Reset, to enrich digital enterprise over physical enterprise.

This tendency for new money to affect different industries in different ways was uncovered by the Irish-English economist Richard Cantillon, writing even earlier than Adam Smith. He said that money is never neutral to economic exchanges but rather integral, so every increase in the supply of money has the effect of rewarding some at the expense of others.

Second, you know what’s not affected by the tendency of prices and wages to go up under inflation? Savings. Your money in the bank was not somehow adjusted further up by virtue of inflation. So Professor Wolfers’ entire analysis is blown up as a result: it simply does not pertain to any deferred consumption of the past.

Savings is the basis of investment and thus future prosperity, so inflationary regimes always punish those who are frugal and reward those who live for today and save nothing. Indeed it is deeply punishing toward long-term thinking in general.

Third, none of Wolfers’ thought accounts for the huge transition costs associated with accounting during inflationary bouts. Every business that runs on small margins in a competitive environment has to deal with balancing income versus expenses on large items and small. Accounting alone consumes vast amounts of operational attention in every business. If your costs are randomly going up for all inputs from labor to materials to just keeping the lights on, and each at different stages and in different ways, it becomes much easier to make mistakes.

In addition, it’s easier said than done to “pass the costs onto the consumer.” The ability to do so always depends on the price elasticity of demand, which is a measure of just how trigger-happy consumers really are toward higher prices. How much will demand be affected by changing prices? There is no way to know in advance, which is why merchants end up testing and treading carefully with hidden fees and shrunken packages. It’s all a matter of making the economy work.

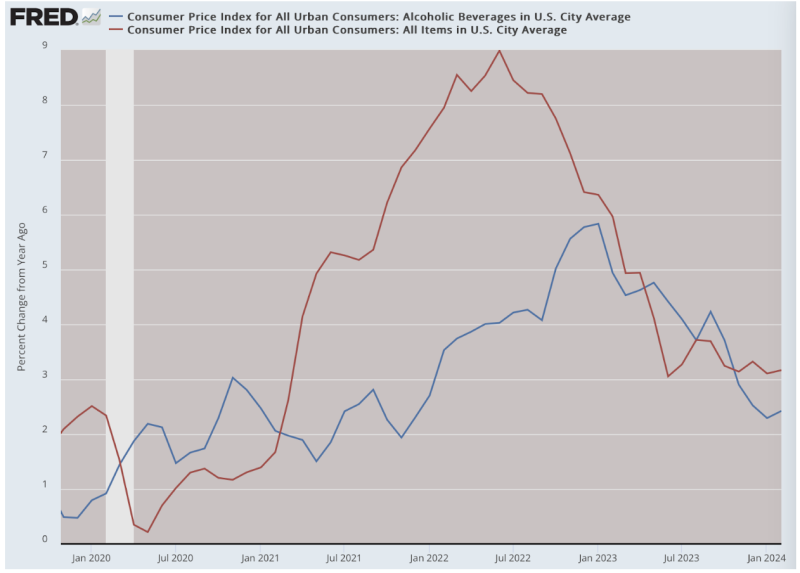

Companies facing less competition and larger profit margins are in a better position to achieve this than those like small businesses which cannot. Therefore the high costs of accounting transitions fall disproportionately on smaller businesses. Did you notice, for example, that liquor prices have not increased nearly as much as other prices? That’s because they were in a position to eat some of their large margins rather than risk reducing demand for their product. That was certainly not true of the corner grocer or the small restaurant.

These are three reasons why this professor’s opinion – born of models in which there are no transition costs, injection effects, or accounting uncertainties – has nothing to do with the real world. And you know this, based on the experience of the last four years. It is an enormous source of frustration when intellectuals use their high-status positions to instruct the public on matters we know to be untrue.

It is also an annoyance to cover up the terrible truths we know. The years 2020-24 were times of one of the greatest head fakes in the history of government and central banking. They showered the world with seemingly free money only to take it all away and then some merely a year later and continuing to this day.

And who won? Look around. Big government is bigger and so is tech and digital businesses in general, while the banks are flush with cash. That tells you all you need to know about who is winning and who is losing in the great inflation racket.

Any economist telling you otherwise needs to let go of the unrealistic otherworld models and take a look at the reality on the ground. He might discover that members of the public are not irrational to be upset but rather entirely in touch with the truth about what has happened to us.

Disclaimer

Some of the posts we share are controversial and we do not necessarily agree with them in the whole extend. Sometimes we agree with the content or part of it but we do not agree with the narration or language. Nevertheless we find them somehow interesting, valuable and/or informative or we share them, because we strongly believe in freedom of speech, free press and journalism. We strongly encourage you to have a critical approach to all the content, do your own research and analysis to build your own opinion.

We would be glad to have your feedback.

Source: Brownstone Institute Read the original article here: https://brownstone.org/