In selecting the date of the next election, Conservative Party strategists have a choice between catastrophe and oblivion. Following the Labour Party’s micro-landslides in Tamworth and Mid-Bedfordshire, and with Rishi Sunak’s conference reset leaving opinion polls unmoved, it seems increasingly unlikely that the Tories can win the next election. But in choosing the occasion of their demise, they should remember one crucial factor: Britain’s economic situation is deteriorating and a 2008-style crash is impending.

In fact, the economy has not looked truly healthy for years and forward-looking indicators imply that a recession is almost certainly in the pipeline in the next six to 18 months. And one of the key reasons that the Tory Party has already haemorrhaged support is due to the poor condition of the post-Covid economy, specifically with respect to the high rate of inflation. This has gradually made itself manifest in poll numbers. According to YouGov, at the beginning of 2021, still in the midst of the Covid pandemic, the most pressing issue in the country was “Health”. And at this time, and for months after, the Tories were still ahead in the general election polls (though Labour were biting at their heels).

As 2021 progressed, the initial burst of inflation caused by the lockdown’s impact on supply chains rippled through the economy. By the start of last year, with inflation running at about 6%, economic matters had overtaken health in YouGov’s polling. Then on 24 February 2022, another inflationary shock hit the world economy: the Russian invasion of Ukraine. It was not primarily the invasion itself that caused the shock, but rather the counter-sanctions undertaken in response, with the European energy supply in particular drying up. In October 2022, with inflation in Britain peaking at around 11% and a population-wide cost-of-living crisis broadly diagnosed by commentators, economic matters dwarfed any other issue. Labour stood at over 50% in some polls.

Which is another way of saying that over the last two years, the Tory Party have lost their credibility on the economy. They have ruled over an inflationary mess. But after years of shedding their veneer of competence, it actually looks as though the worst is still to come. Even though Britain has a serious cost-of-living crisis, most people who want work can find it. Until recently, the unemployment rate has been historically low — in 2022 it touched 3.5%, a record that had not been seen in over 40 years. But this is beginning to change. Unemployment has been ticking up since April of this year, with recent reports suggesting that it is set to increase even further. The media has been largely silent about this issue, but economists have been paying attention. After all, the Bank of England has been aggressively increasing interest rates since the beginning of 2022, raising them from almost 0% to 5.25%. Few economists would think that these sorts of hikes can be achieved without generating a recession.

The British economy is particularly prone to higher interest rates, most glaringly through its overinflated and economically axial housing market. At its previous peak in 2007, before housing crashed worldwide, the average house in England was worth around 7.15x the average salary. Fifteen years later, this has risen to 8.28x — a record high. And though our housing debate is dominated by questions of supply — the intractable Yimby v Nimby contestation — there is every reason to think that the current inflation in house prices is another speculative mania of the sort we saw collapse in 2008.

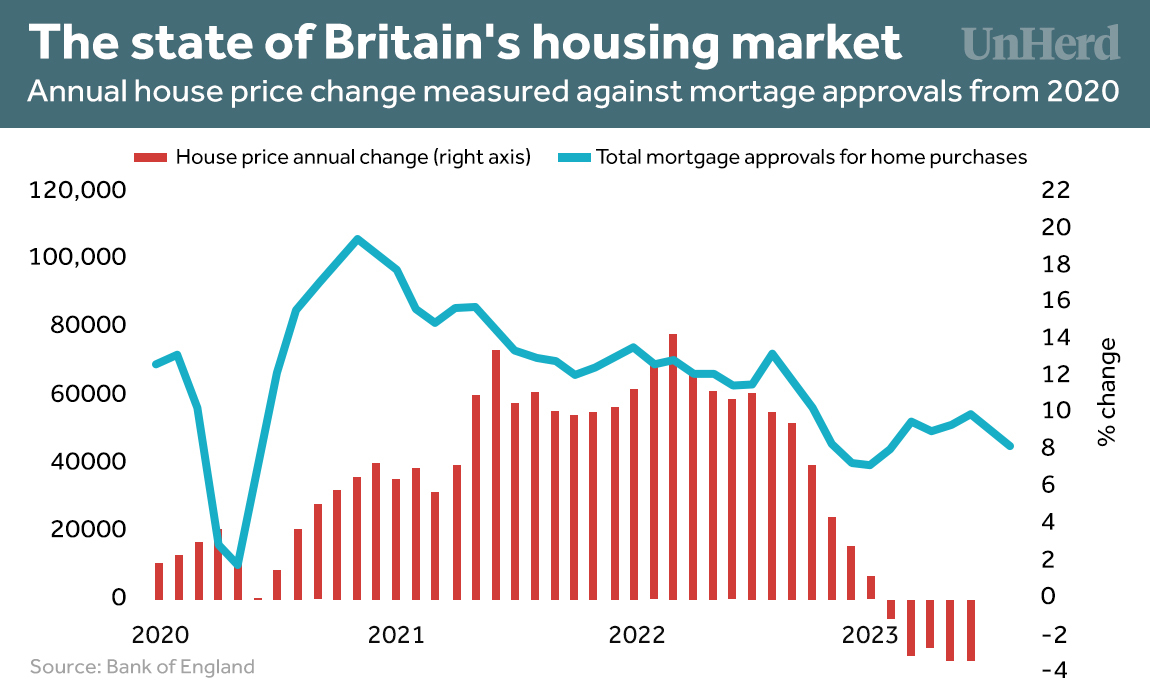

It is already telling that the housing market has proven completely unable to stomach higher interest rates. House prices have been falling every month since January of this year and in the third quarter of 2023 the average house price was down nearly 5% from its peak. While this may not seem like much, declines in house prices of this nature this rarely bottom out quickly and usually signal further falls. The pressure in this regard can be seen in the falling number of mortgage approvals in Britain, a contraction which dates back to 2020. Mortgage approvals went into steep decline after August 2022 as the Bank of England interest rate rose to just under 2%; it was shortly after this that house prices themselves began to decline.

And this is leading to a consequent decline in construction as firms pull out of new projects, no longer confident of a return on their investments. Private housing construction output in August was down 7.1% since the start of the year, and 15.9% from its peak in May 2022. The labour market is already beginning to mirror this trend. Between July and September, vacancies in the real estate sector fell 29.6% from the previous quarter. It is very likely that — for the second time this century — the Great British housing bubble has burst. And, just as in 2008, it is taking the rest of the economy with it. A deep recession is now very probable.

How this recession interacts with politics is another question. As we have seen, the Conservative Party have already lost their credibility on the economy. If they go into an election with the economy in recession and the unemployment rate rising, they will get eviscerated. A few months ago, there was chatter within the party that maybe they should hold out, see if the Bank of England could get inflation under control, and hope that the economy improves. That position is no longer tenable. Inflation may be coming down, but the economic situation is spiralling beyond the control of central banks, and if the Tory strategists think that the public dislike inflation, just wait until they find out how much they abominate a recession and rising unemployment.

Political strategists are rightly sceptical of those wielding crystal balls. For every accurate forecast, there are a handful of inaccurate ones. Yet all the statistics currently show that the British economy is in a rapid state of decline. For this reason, the Tories might think of what they are facing as what investors refer to as an “asymmetric bet”. This is a gamble in which the loss incurred from losing is far greater than the gain incurred from winning. It is as if two people gamble on a coin toss, but while one gets £1 if he wins the other gets £100 if he wins.

The asymmetric bet the Tories are currently facing is roughly as follows. If they continue sitting on their hands, hoping that the electoral gods will smile favourably on them, the economy may fall into recession. If this happens, the party will lose vastly more seats than they would lose if an election were called today. On the other hand, if the economy stabilises or even improves slightly, people will barely notice. Skyrocketing growth and a booming housing market is simply not on the cards and anyone who tells you otherwise is trading in snake oil.

On the other side of the bet is Labour. The polling seems to suggest that most people are willing to give Labour a punt in the hope that they can improve the economic situation. The policies that Labour are putting forward that are popular, especially with their base, all involve spending lots of money. This means that if Labour are handed the reins and soon thereafter the economy falls into recession, support for the party will dry up. As the recession hits government tax revenues, Labour will find themselves encircled by the same furious markets that brought down the Truss government. They will be forced impose austerity, and support for the party will likely collapse within 12-18 months.

The statistics do not lie. Recession in the coming months seems very likely, if not almost certain. And its arrival will provide a reminder of how economics undergirds the daily rigamarole of politics. The most important political event of the 21st century so far remains the Great Recession, triggering the populist uprisings and neoliberal collapse that has defined our recent history. The Conservatives and Labour can attempt to read the runes of the British financial system, trying to divine economic growth and surf its waves. But the economy does not serve to buttress political dignity — and whichever party winds up in power will soon have to reckon with the consequences.

Disclaimer

Some of the posts we share are controversial and we do not necessarily agree with them in the whole extend. Sometimes we agree with the content or part of it but we do not agree with the narration or language. Nevertheless we find them somehow interesting, valuable and/or informative or we share them, because we strongly believe in freedom of speech, free press and journalism. We strongly encourage you to have a critical approach to all the content, do your own research and analysis to build your own opinion.

We would be glad to have your feedback.

Source: UnHerd Read the original article here: https://unherd.com/